You can expect pelvic floor reconstruction to be covered by insurance if your condition meets medical necessity criteria and the procedure is well-documented by your healthcare provider. Insurance plans vary, with private, employer-sponsored, Medicare, and Medicaid policies potentially covering the surgery based on specific eligibility and documentation requirements. Prior authorization is often needed, and detailed records help support your claim. Understanding these factors is key to successfully managing coverage for this specialized surgery.

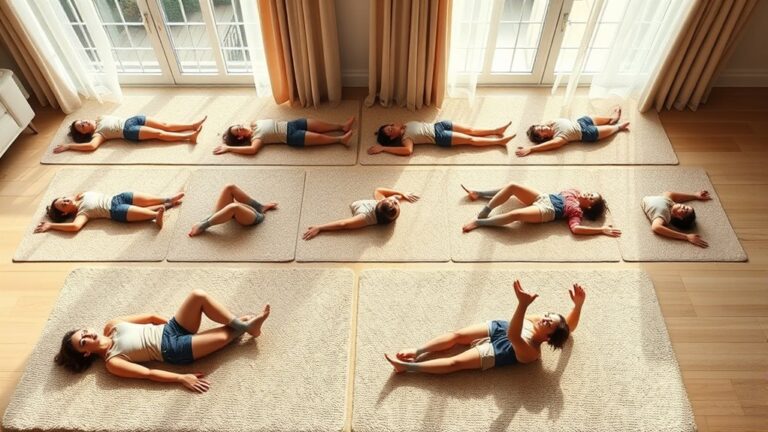

Understanding Pelvic Floor Reconstruction

Although pelvic piso reconstruction may not be a familiar term to everyone, it refers to a specialized surgical procedure designed to restore the normal function and support of the pelvic organs. You need to understand pelvic anatomy deeply, as this procedure targets muscles, ligaments, and connective tissues that maintain organ position and function. Surgical techniques vary based on the extent of damage or prolapse, employing approaches such as native tissue repair, mesh implantation, or minimally invasive laparoscopic methods. Each technique aims to reestablish structural integrity and improve quality of life, granting you freedom from symptoms like incontinence or pelvic pressure. Mastery of these surgical methods guarantees tailored treatment that respects your anatomical needs and functional goals, emphasizing precision and durability in restoring pelvic floor stability.

Factors Affecting Insurance Coverage

Understanding the complexity of pelvic floor reconstruction helps clarify why insurance coverage can vary considerably. Your insurance policy dictates coverage limits, medical necessity criteria, and prior authorization requirements, all impacting whether your procedure is covered. Additionally, the specific diagnosis and documented severity influence insurer decisions.

| Factor | Impact on Coverage |

|---|---|

| Insurance Policy Type | Determines inclusion/exclusion criteria |

| Medical Necessity | Proof required to justify procedure |

| Coverage Limits | Caps on benefits may restrict coverage |

| Documentation | Detailed records support claim approval |

Types of Insurance Plans That May Cover the Procedure

When seeking coverage for pelvic floor reconstruction, you’ll find that various insurance plans offer differing levels of support based on their design and policies. Private insurance plans, including employer-sponsored group policies and individual health plans, often provide coverage if the procedure is deemed medically necessary. However, coverage specifics can vary widely between plans, so reviewing your policy details is essential. Government programs like Medicare and Medicaid may also cover pelvic floor reconstruction, particularly when the condition considerably impairs function or quality of life. Eligibility criteria and coverage limitations differ by state and program type, so consulting your plan administrator or caseworker is advisable. Understanding these distinctions empowers you to navigate insurance options effectively, ensuring access to necessary care without unexpected financial burdens.

Documentation and Medical Necessity Requirements

Determining insurance coverage for pelvic floor reconstruction depends heavily on meeting specific documentation and medical necessity criteria. You must guarantee that all relevant medical documentation clearly outlines your diagnosis, symptom severity, previous treatments, and functional impairments. This evidence supports the necessity evaluation conducted by insurance providers to confirm that the procedure is not elective but essential for your health and quality of life. Properly detailed records from your healthcare provider, including imaging studies, clinical notes, and test results, are critical to substantiate the claim. Without thorough and precise medical documentation, insurers may deny coverage, limiting your access to necessary care. Understanding and fulfilling these requirements empowers you to advocate effectively for your treatment and secure the insurance benefits you rightfully deserve.

Tips for Successfully Navigating the Insurance Claims Process

How can you guarantee a smoother insurance claims process for pelvic floor reconstruction? Begin by thoroughly reviewing your policy to identify any policy exclusions that may affect coverage. Confirm all medical documentation clearly establishes the procedure’s necessity, aligning with insurer requirements. If a claim is denied, promptly initiate a claims appeal, providing additional evidence or expert opinions to support your case. Maintain organized records of all correspondence and medical reports to streamline communication. It’s essential to understand insurer timelines and adhere strictly to deadlines for submissions and appeals. By proactively managing these steps and understanding your rights, you can minimize delays and improve your chances of success. This disciplined approach empowers you to navigate the insurance system effectively, securing the coverage you need with confidence and control.